WHY AIF - Comparison & Advantages Of AIF To Traditional Investment Funds

| Stelios AIF CAT III | Equity Mutual Fund | Equity PMS | |

| Equity upside participation | Yes | Yes | Yes |

| Downside protection | Yes | No | Limited |

| Investment Flexibility for the Manager | Yes | No | Yes |

| Ability to take advantage of the short side | Yes | No | No |

| Use of leverage to enhance returns | Yes | No | No |

| Exposure to Hedge Fund styled algorithms | Yes | No | No |

| Investment Manager orientation | Absolute return | Relative return | Relative return |

Advantages of AIF CAT III Fund

| 1. Active Management | 2. Long/Short allowed |

| 3. Leverage up to 2X allowed | 4. Participation in Equity downturns |

| 5. Hedge Fund styles allowed | 6. Quantitative algorithms allowed |

| 7. Net lower correlation with benchmarks | 8. Lower systematic risk vs benchmarks |

| 9. Lower Value-at-Risk (VaR) vs benchmarks | 10. Higher Sharpe ratios vs benchmarks |

| 11. Diversification across sectors | 12. Diversification across asset classes |

| 13. Exposure to Alternative strategiest |

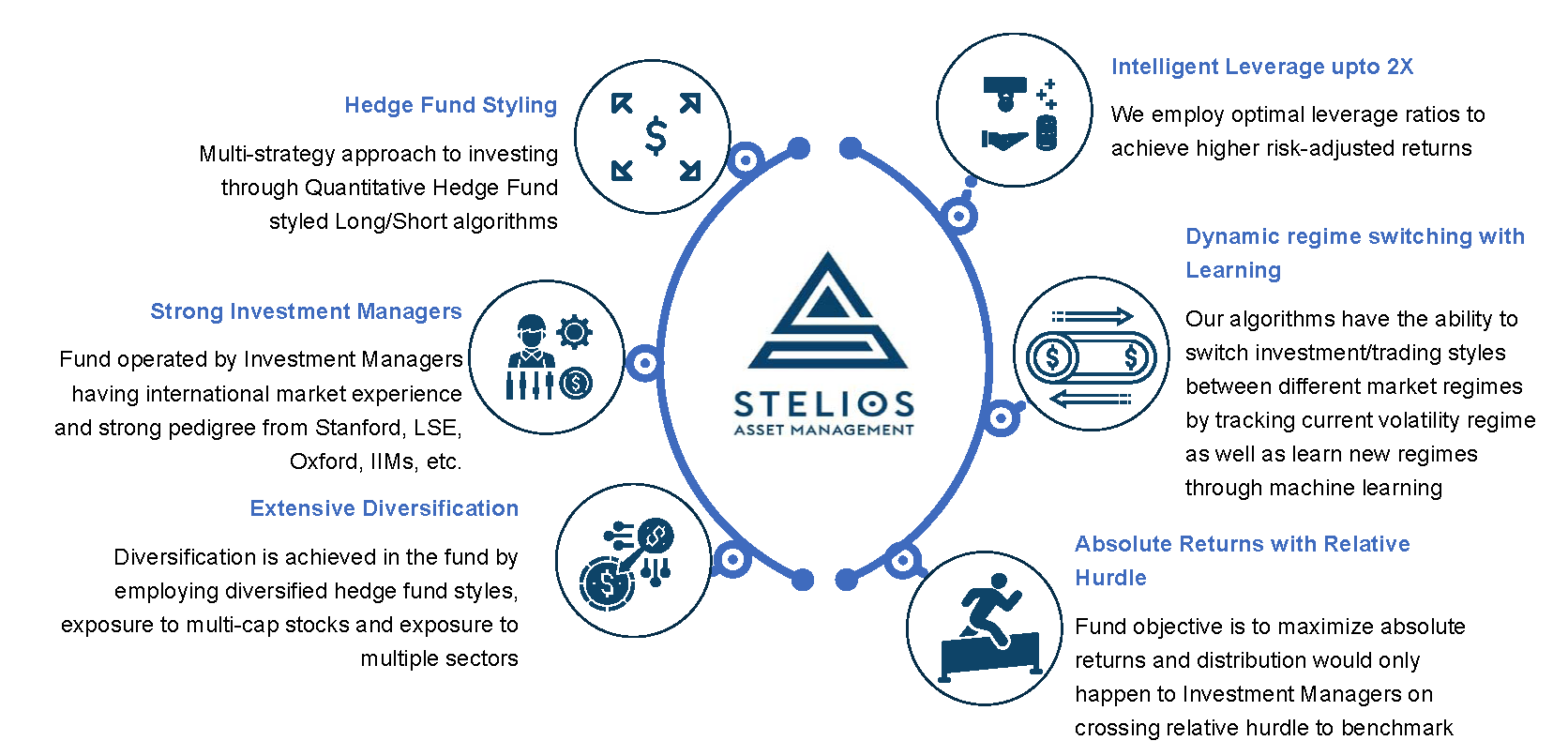

WHY STELIOS AIF

Investment Philosophy and Strategy - A Rigorous Bottom-up Research And Strict Risk Management Guidelines

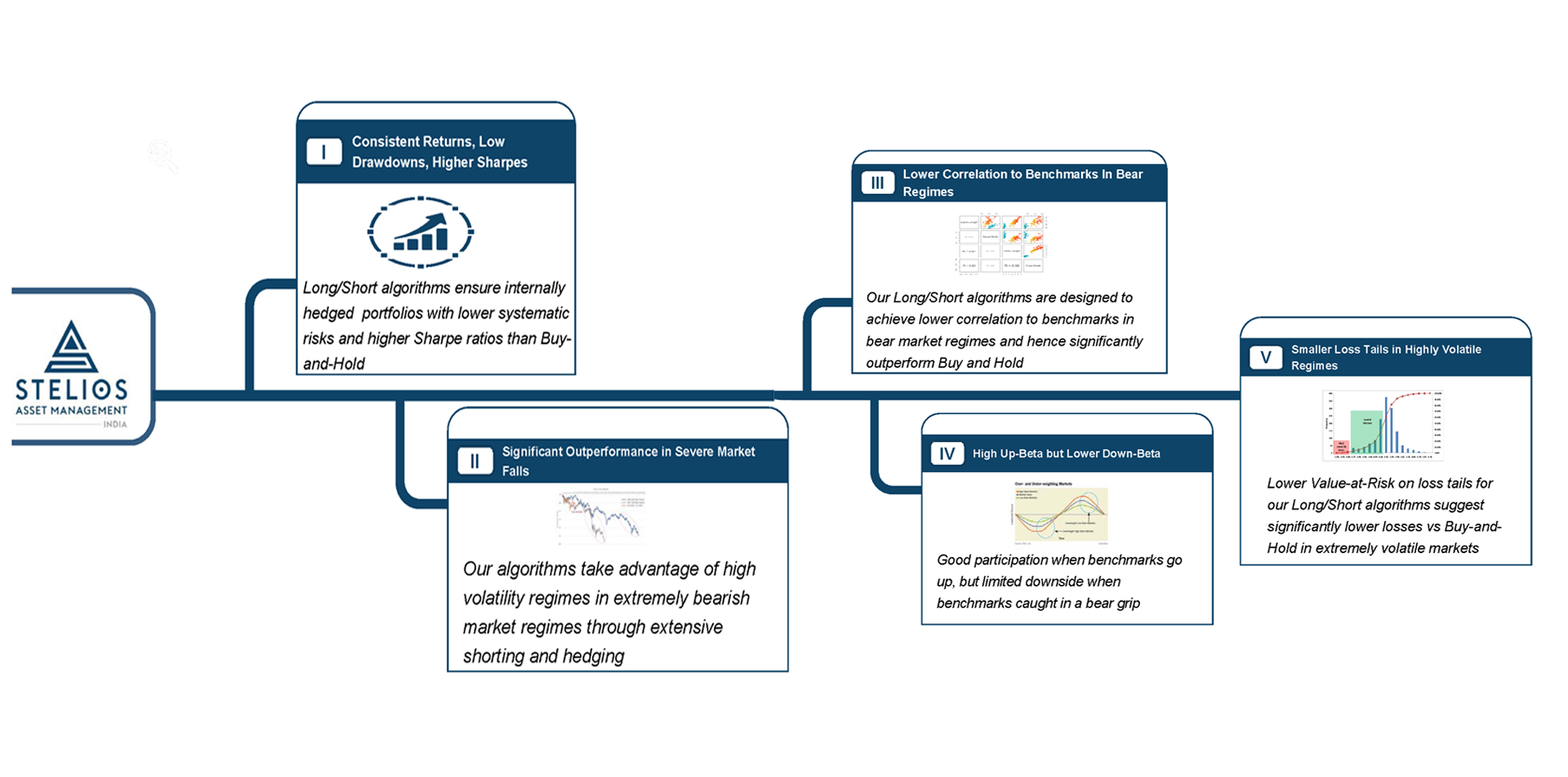

FALLOUT OF FUND STYLING

Risk & Returns Characteristics