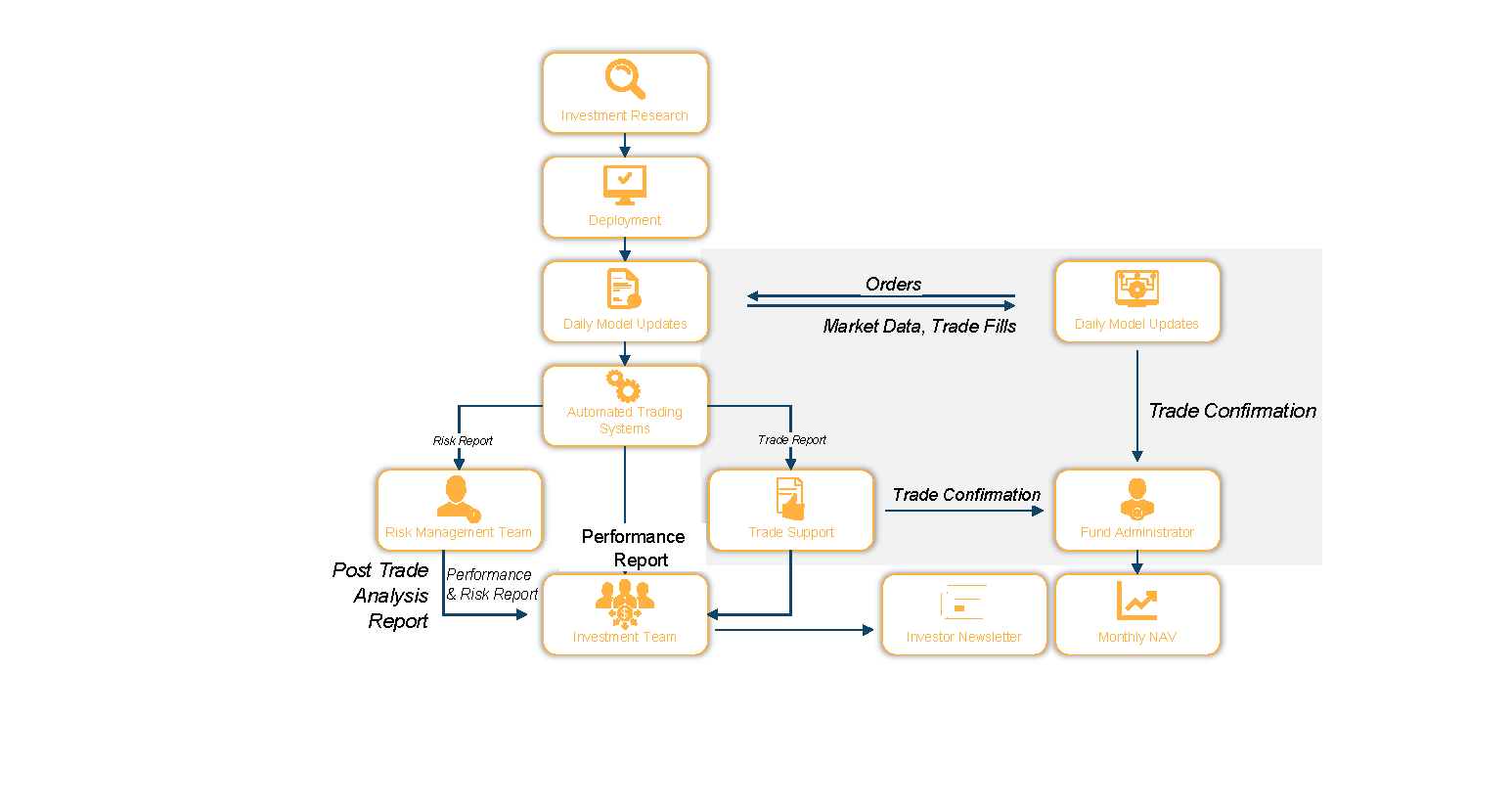

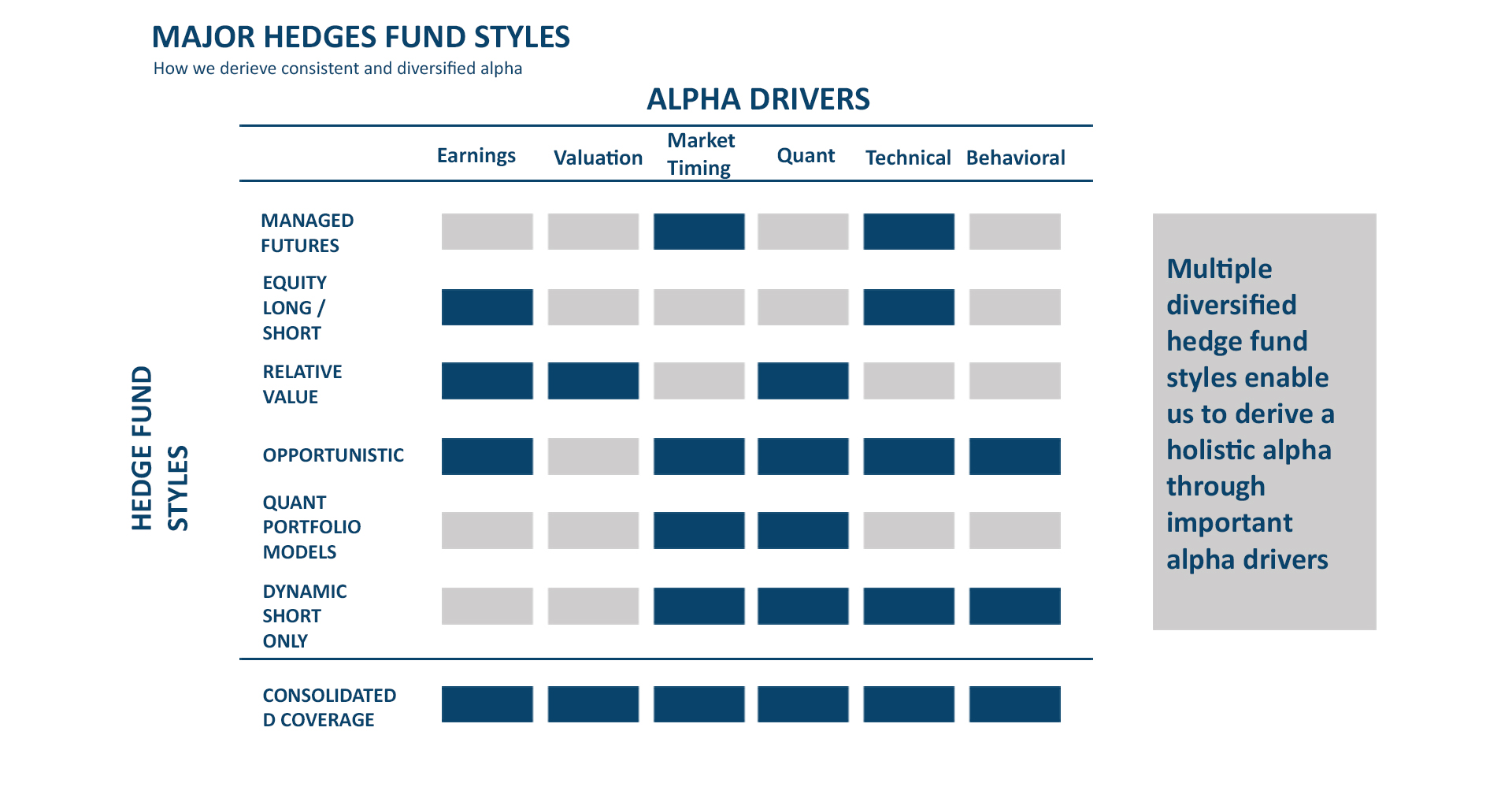

MAJOR HEDGE FUND STYLES

How we derive consistent and diversified alpha

FUND STYLING

Investment Styling - How Does Our Quantitative Algorithmic Hedge-Fund Styling Beat Traditional Asset Management?

| 1. Active selection of portfolio; | 2. Ability to take advantage of market downturns; |

| 3. Risk optimized leverage; | 4. Lowering systematic risk; |

| 5. Diversification into multiple sectors; | 6. Market Timing. |

FUND STYLING

Investment Styling - How Does Our Quantitative Algorithmic Hedge-Fund Styling Beat Traditional Asset Management?

MANAGED FUTURE / CTA

- Mostly trend following in nature

- Capacity to profit from bear markets as well as from bull markets

- Suitability for sector diversification of portfolio

- Efficient use of low cost derivatives market

- Participate in a wide variety of financial products and markets not available in traditional investment products (e.g., commodities)

| 1. Active selection of portfolio; |

| 2. Ability to take advantage of market downturns; |

| 3. Risk optimized leverage; |

| 4. Lowering systematic risk; |

| 5. Diversification into multiple sectors; |

| 6. Market Timing. |

EQUITY LONG / SHORT

- Equity Long / shorts involves share based investing on both the long and short side of the market across a range of sectors, categories and region

- Represents the largest amount of hedge funds assets

- Lower beta and lower systematic risk due to market neutral nature

| 1. Active selection of portfolio; |

| 3. Risk optimized leverage; |

| 4. Lowering systematic risk; |

| 5. Diversification into multiple sectors; |

RELATIVE VALUE

- Simultaneously long and short positions in closely related markets

- Use of arbitrage to exploit the mis-pricing and other opportunities

- Capturing the spread between two assets, while maintaining neutrality to other factors

- Non-correlation to the general equity and debt markets

| 1. Active selection of portfolio; |

| 4. Lowering systematic risk; |

| 6. Market Timing. |

OPPORTUNISTIC

- Specialise in investments in capital markets that offer unique investment characteristics, outsized opportunity for excess return, and risk benefits

- Seek to profit opportunistically from fundamental themes, inefficiencies and dislocations in the financial markets

- Top-down approach to identify long and short investment opportunities

| 1. Active selection of portfolio; |

| 2. Ability to take advantage of market downturns; |

| 3. Risk optimized leverage; |

| 6. Market Timing. |

QUANTITATIVE PORTFOLIO MODELS

- Quantitative portfolio Models is a strategy which evaluates by employing primarily statistical and quantitative modelling and predictive analytics to identify and capture opportunities

- Uses proprietary models to increase their ability to beat the markets

- Quantitative portfolio Models also include momentum and contrarian strategy

| 1. Active selection of portfolio; |

| 3. Risk optimized leverage; |

| 4. Lowering systematic risk; |

| 5. Diversification into multiple sectors; |

| 6. Market Timing. |

DYNAMIC SHORT ONLY

- Dynamic short only positions generally consists of those securities that are trading at significant premium to intrinsic value and are likely to decrease in value in the near to intermediate terms

- Short sell involves selling the securities of issuers that are believed t be overvalued based upon an assessment of the prospects of those issuers

| 1. Active selection of portfolio; |

| 2. Ability to take advantage of market downturns; |

| 3. Risk optimized leverage; |

| 4. Lowering systematic risk; |

| 5. Diversification into multiple sectors; |

| 6. Market Timing. |

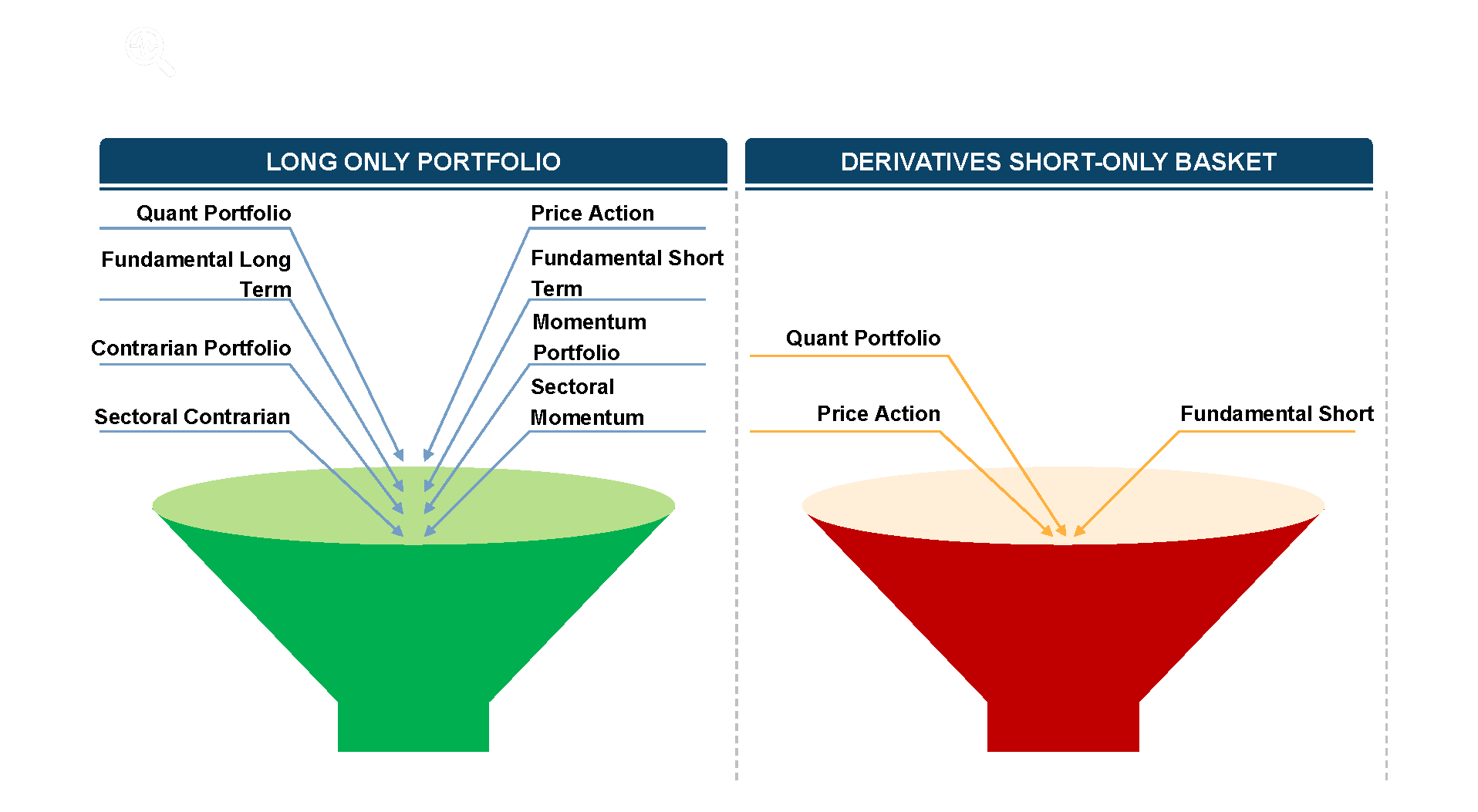

LONG/SHORT STYLE

Allocation Process dynamics

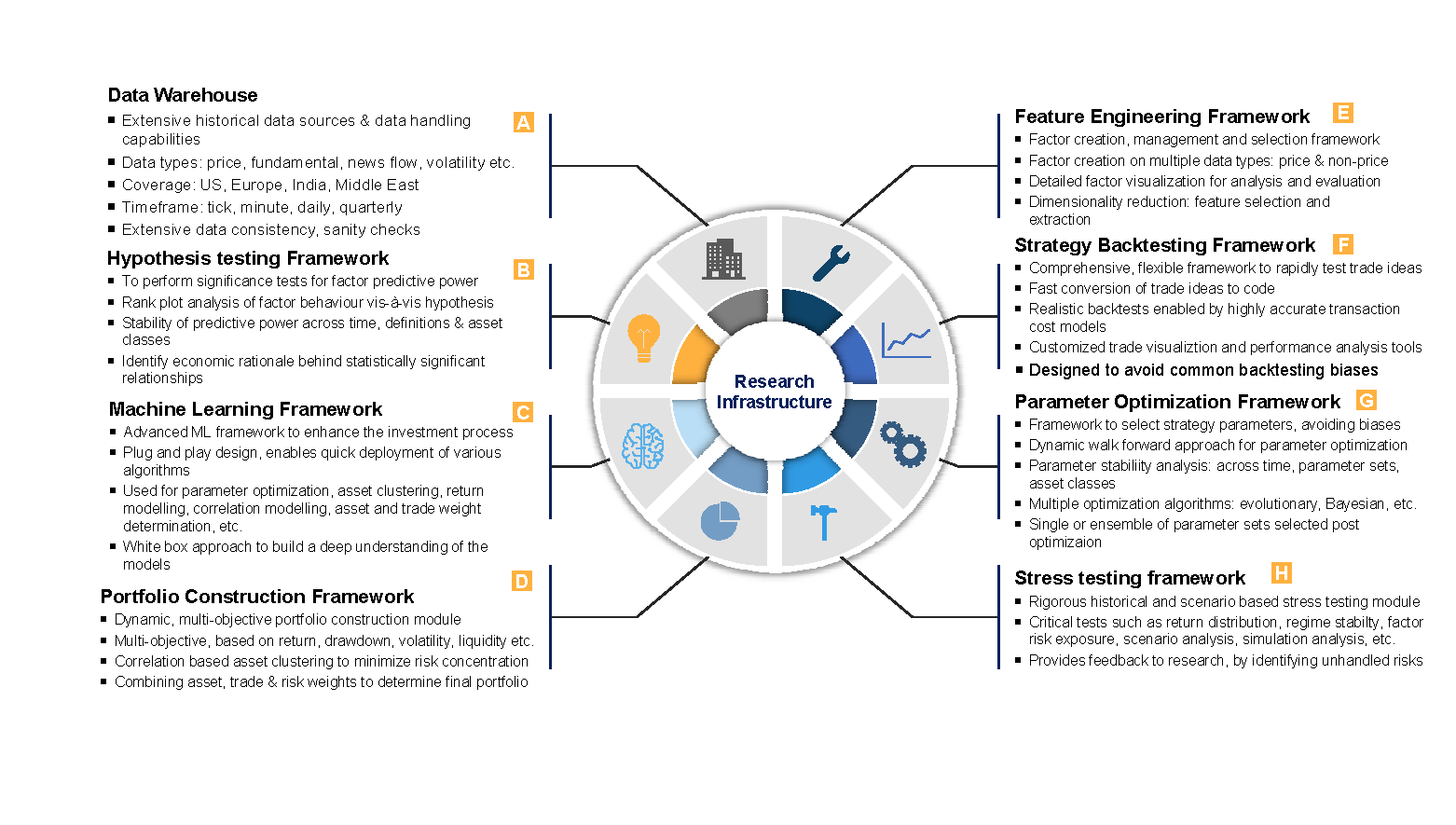

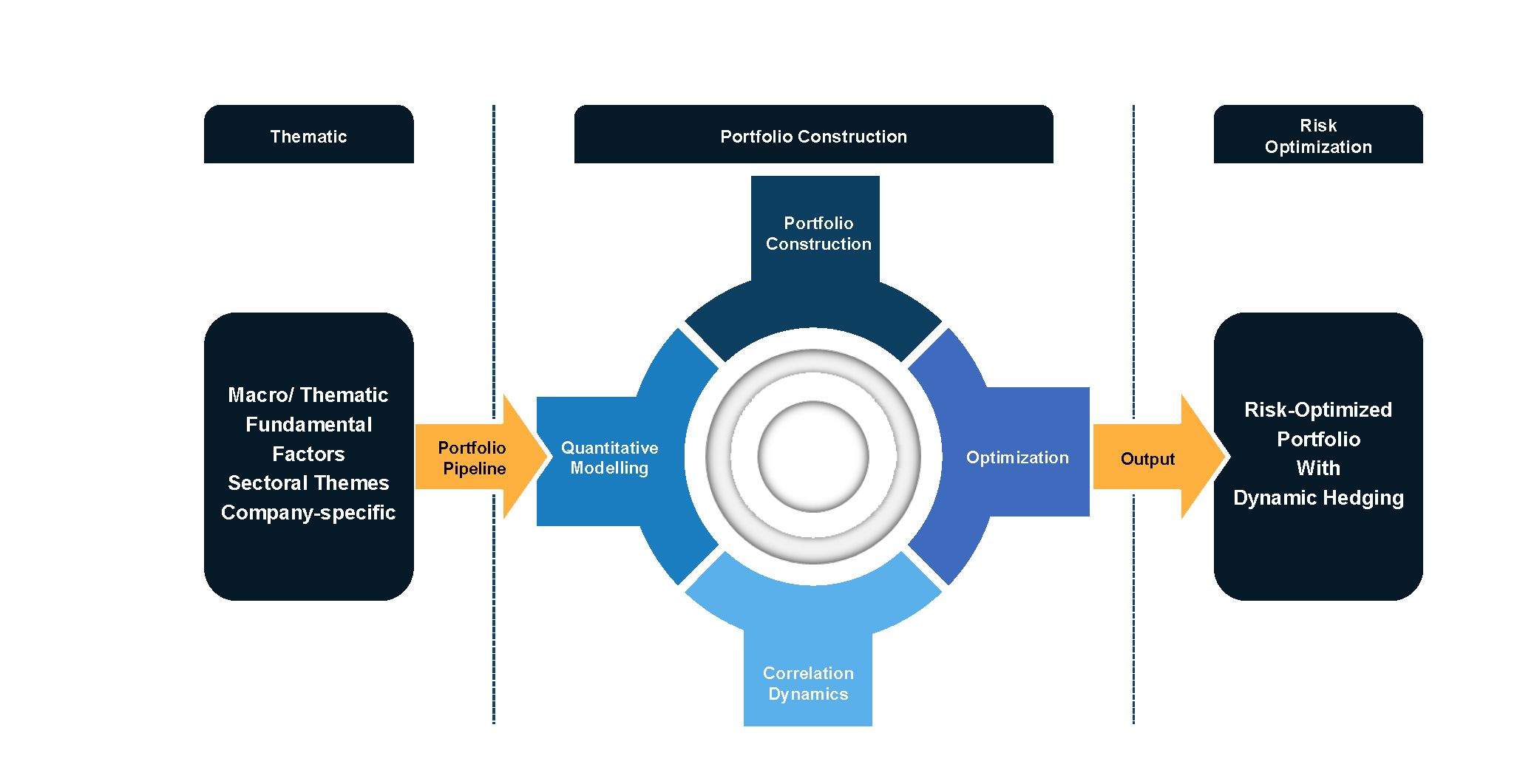

INVESTMENT PROCESS MAP

Our unique Investment Identification Process Map

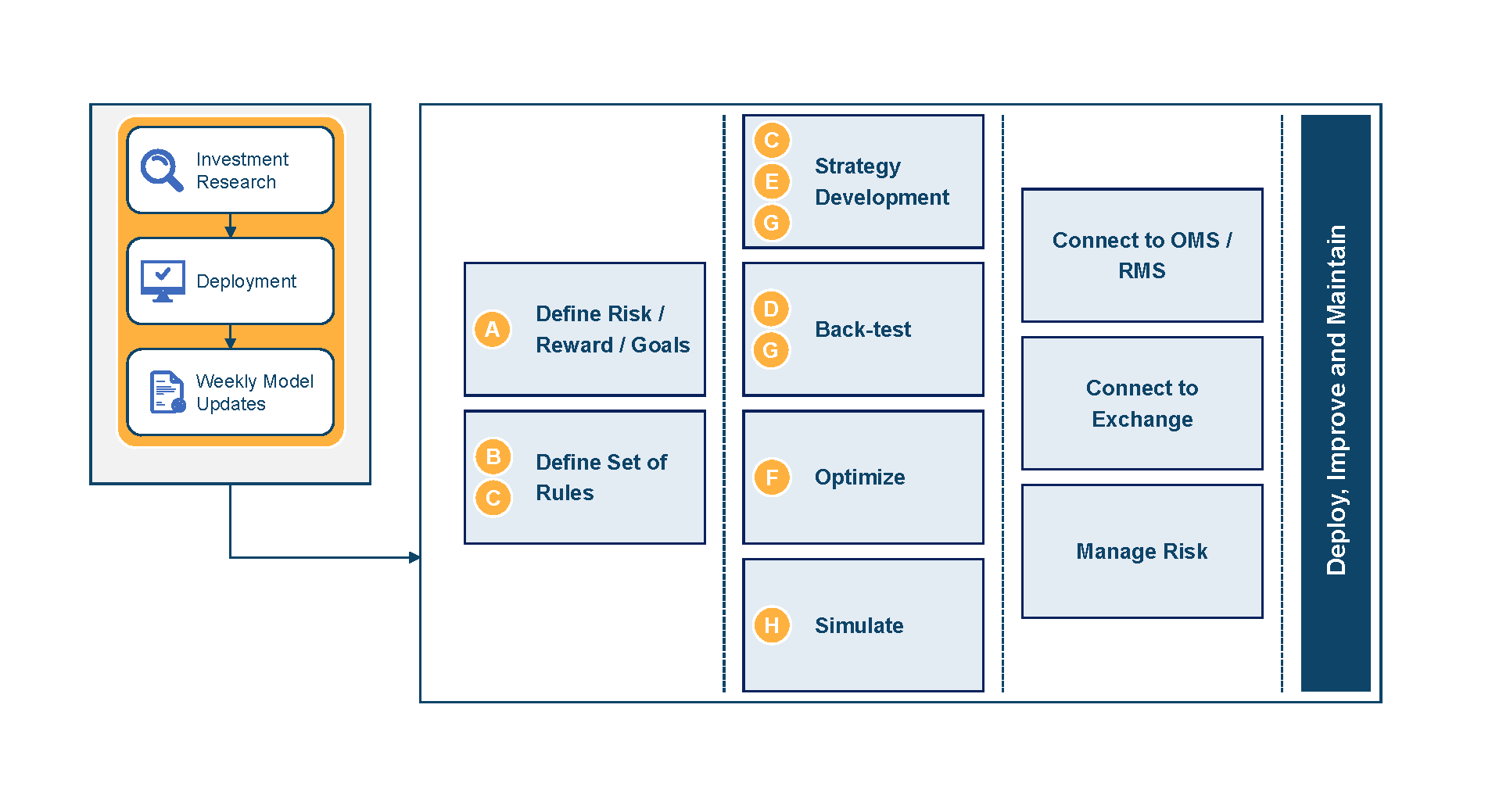

INVESTMENT RESEARCH WORKFLOW

Our Investment Management Processes and Framework

AUTOMATED EXECUTION WORKFLOW

Summary of key important processes in the Automated Execution, Reconciliation and Report Generation frameworks